There is a common misconception that ‘Disclosed Quantity’ hides your quantity to others. What it actually does is, your stock broker (Eg: Upstox) would break your quantity into multiples of “Disclosed Quantity” and it is displayed in the market in smaller numbers at a time. Once this quantity is successfully traded, the next lot is processed and so on …

What is the need for this?

Say someone were to by 10,000 shares of INFY. If an order (buy or sell) of 10k units were to be displayed in the market at a time, there would be a possibility of panic or an un-intended sway of trade direction.

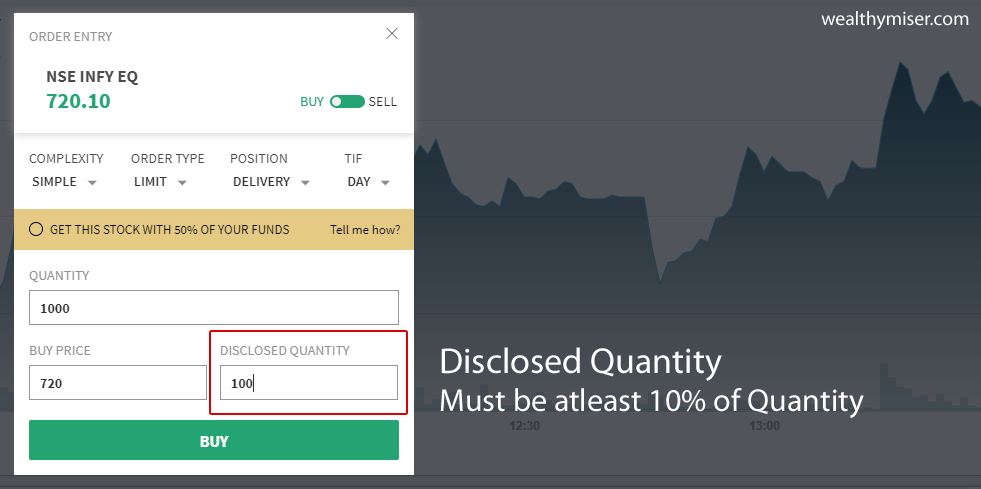

It is to be noted that DQ cannot be less than 10% of the total

Advantages

- For anyone trading in very large quantities, this can be helpful for masking total quantity and faster execution of orders (sometimes)

Disadvantages

What is "Disclosed Quantity" in stock trade? Its Advantages and Disadvantages